We Beat Every Deal.

All day. Every day.

Tired of being let down by empty promises and sky-high rates? We are here to change the game. We don’t just offer mortgages; we redefine what it means to get the best mortgage deals. Our pledge? Unbeatable mortgage rates that no one else can match.

Forget settling for average. With us, you get the lowest mortgage rates in the market, hands down. Our team of fierce negotiators doesn’t rest until we’ve crushed every offer and brought you the best home loan deals. We don’t play by the rules; we set them.

Don’t waste another minute with outdated lenders. We are your ticket to a hassle-free, money-saving mortgage adventure. Whether you’re a first-time homebuyer or looking for mortgage refinancing, we’ve got your back with the best mortgage offers.

Contact us today and let us show you what it means to truly beat every deal.

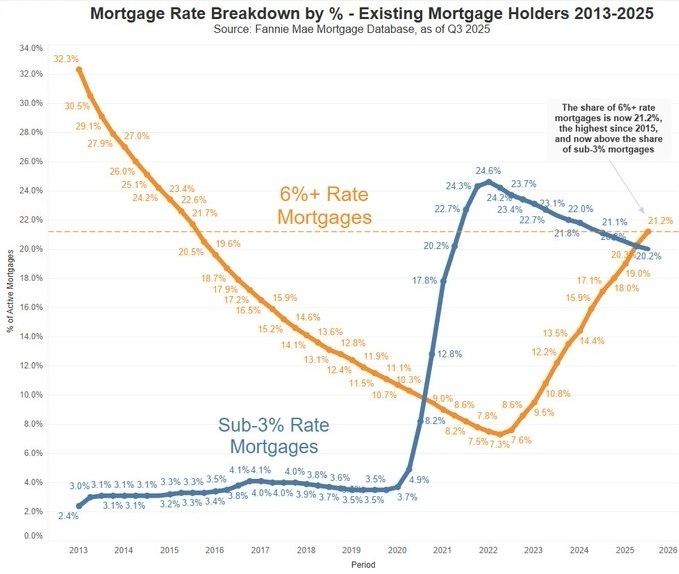

Find out what this rate drop means to you for buying a new home.

Find out what the experts are anticipating for 2026 housing

A holiday-week catch-up: light trading kept markets mostly sideways, but the average 30-year fixed edged to near two-month lows as bonds got a small lift from Europe and pending home sales improved.